How FinTech Is Reshaping eCommerce Payments (UPI, Wallets, BNPL & Beyond)

By Shivam Sati · Published on December 25, 2025

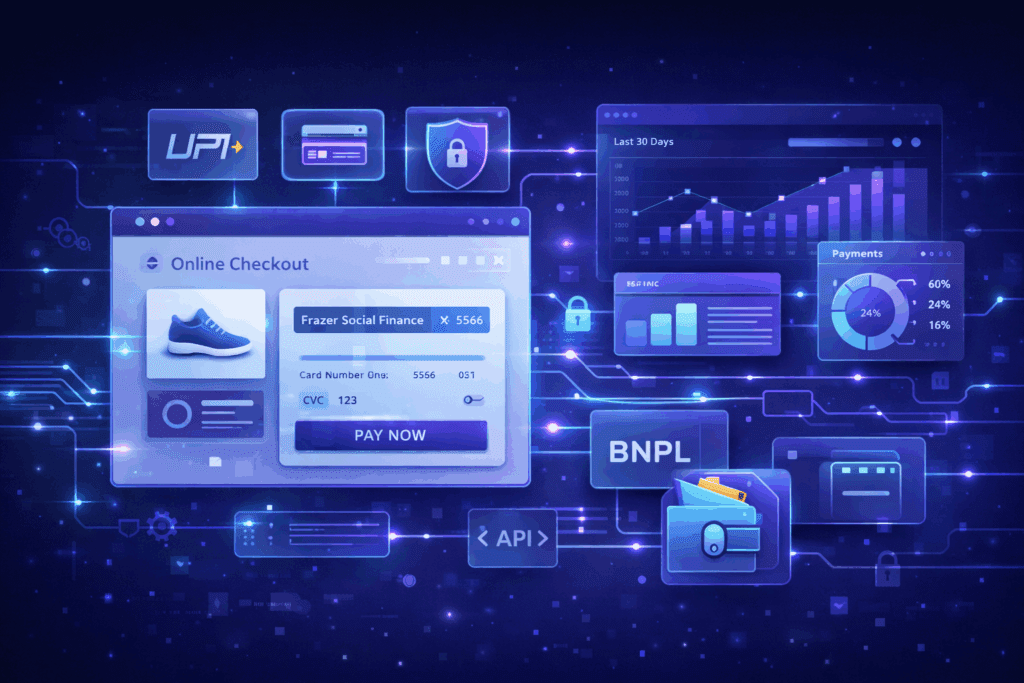

FinTech eCommerce payments are transforming how online businesses handle checkout, security, and customer trust in 2025. The way people pay online has changed faster than most eCommerce websites have adapted. In 2025, payments are no longer just a final step in the checkout process. They are a core part of user experience, trust, and conversion.

FinTech is reshaping eCommerce payments through instant transfers, digital wallets, Buy Now Pay Later options, and API-driven systems that remove friction from online transactions. Businesses that fail to adapt lose customers at the checkout stage.

Why Payments Matter More Than Ever in eCommerce

Checkout is where money is either made or lost. Studies consistently show that a complicated or slow payment experience is one of the top reasons for cart abandonment.

Modern customers expect:

- Fast transactions

- Familiar payment methods

- High security

- Minimal steps

Reshaping eCommerce in FinTech directly addresses these expectations by redesigning how payments work behind the scenes.

UPI and Instant Payments: Speed Wins

Unified Payments Interface (UPI) and other instant payment systems have transformed online transactions, especially in mobile-first markets.

Why UPI works so well:

- Real-time payments

- No card details required

- High trust among users

- Seamless mobile experience

For eCommerce platforms, Reshaping UPI reduces friction, improves success rates, and speeds up checkout dramatically. Websites that integrate instant payments correctly see higher conversion rates compared to traditional card-only systems.

Digital Wallets: Convenience and Trust

Digital wallets have become a default choice for many users. They store payment details securely and allow users to pay in seconds.

Benefits of wallets in eCommerce:

- Faster checkout

- Reduced payment errors

- Improved user trust

- Better mobile experience

From a development perspective, wallet integration simplifies the user journey and lowers drop-offs during payment.

Buy Now, Pay Later (BNPL): Growth With Caution

BNPL has become one of the fastest-growing FinTech solutions in eCommerce. It allows customers to split payments into smaller installments without immediate full payment.

Why Reshaping ecommerce helps in BNPL Sales boosts:

- Higher average order value

- Lower purchase hesitation

- Increased conversion rates

But there are risks:

- Payment defaults

- Regulatory concerns

- Overuse by customers

BNPL works best when implemented responsibly, with clear communication and proper risk assessment.

Payment APIs and Automation

Modern FinTech relies heavily on APIs to connect payment gateways, wallets, banks, and fraud detection systems.

What APIs enable:

- Faster integrations

- Multiple payment methods in one system

- Better scalability

- Real-time transaction updates

API-driven payments allow businesses to adapt quickly to new FinTech innovations without rebuilding their entire platform.

Security and Trust in FinTech Payments

As payment options increase, so do security risks. Customers will abandon a website instantly if they feel unsafe.

Modern FinTech systems focus on:

- Encryption and tokenization

- Secure authentication

- Fraud detection

- Compliance with payment standards

Reshaping ecommerce Security is not just a technical requirement. It directly affects trust, brand reputation, and long-term customer loyalty.

What This Means for Reshaping eCommerce Businesses

In 2025, successful eCommerce platforms:

- Offer multiple payment options

- Prioritize speed and simplicity

- Integrate FinTech solutions cleanly

- Build trust through secure systems

A modern payment experience is no longer a competitive advantage. It is the baseline expectation.

❓ Frequently Asked Questions About FinTech in eCommerce

What are FinTech Reshaping eCommerce payments?

FinTech eCommerce payments refer to modern digital payment systems such as UPI, digital wallets, BNPL, and API-based gateways used in online stores.

Why is FinTech important for eCommerce in 2025?

FinTech improves payment speed, security, and user experience, which directly reduces cart abandonment and increases conversions.

Is BNPL safe for Reshaping eCommerce businesses?

BNPL can be safe when implemented responsibly with proper risk assessment and transparent payment terms.

Final Thoughts

FinTech is no longer supporting eCommerce. It is Reshaping eCommerce .

UPI, digital wallets, BNPL, and API-driven payment systems are redefining how users interact with online stores. Businesses that adapt gain higher conversions and customer trust. Those that don’t quietly lose revenue at checkout.

The future of eCommerce belongs to platforms that make payments invisible, fast, and reliable.

📩 Need a Better eCommerce Website?

If your eCommerce website struggles with slow performance, poor checkout experience, or outdated payment integration, we can help. We design and develop modern, secure, and scalable websites with smooth FinTech payment solutions like UPI, digital wallets, and BNPL. Our focus is on building websites that load fast, build trust, and convert visitors into customers.

📧 Email: [email protected]

📞 Phone: 9306526234

Previous Post

Why Websites Fail in 2025 More Than Ever (And How...

Next Post

5 Ways UPI Online Payments in India Have Transformed Digital...

Comments (0)

No comments yet. Be the first to share your thoughts.

Related Posts

AI-Driven Personalization in eCommerce: How to Boost Conversions in 2026

Customer expectations in eCommerce have changed permanently. Shoppers no longer respond to generic homepages, static product listings, or…

Why Most Businesses Outgrow Their Website Faster Than They Expect

Many businesses believe a website is a one-time project. Build it, launch it, and move on. That mindset…

Why More Payment Options Can Actually Hurt eCommerce Conversions in 2025

At first glance, offering more payment methods sounds like a smart strategy. Cards, UPI, wallets, BNPL, EMI, net…